The FreeLunchTrading “Layer 1 10x” index tracks foundational assets in the crypto ecosystem by investing in the largest base settlement and smart contract networks. Each asset offers unique advantages in processing speed, data structures, consensus, and client software which optimizes them for certain users or industries. L1-10x contains some of the top ranking eligible constituents of FreeLunchTrading’s indexes, meaning they are regulatory compliant, meet liquidity requirements, and have strong historical data.

Rationale: A passive index capturing the base network layer of the crypto market which is easier to hedge and trade.

Smart Contract Platforms

Cryptocurrencies have proven to be the best performing asset class over the last decade. These digital assets embody an alternative monetary system that offers novel solutions to the corruption, centralization, and lack of transparency that has become standard in fiat currencies and central banking. Bitcoin has unique advantages as a global currency because it is physically supported across the world with open access, making it significantly less vulnerable than centrally operated currencies. No single organization has direct control of the history or mechanics of Bitcoin.

Bitcoin has quickly grown in value and adoption since its release, and increasingly ranks higher among the top 50 fiat currencies by market cap.(1) The code that operates Bitcoin is very concise and purpose built, which makes it reliable as a currency but less optimal for building more complex applications. Smart contract networks bring the unique benefits of Bitcoin to complex transactions on the internet and are able to execute any application, like an exchange or a video game, on a distributed open-source infrastructure. The comprehensive abilities of smart contracts have inspired ecommerce platforms, finance applications, open markets, and new assets like NFTs. As competition builds and network effect grows, smart contract platforms provide a robust infrastructure for a revolution in self-sovereignty and open-business.

Growth and Potential

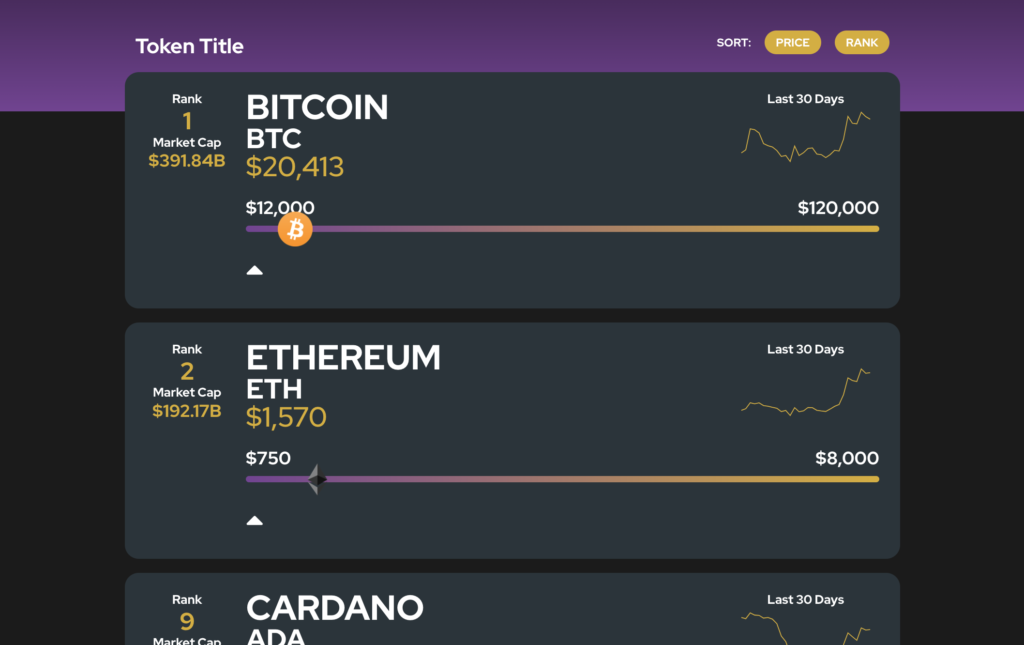

With Bitcoin dominance in the crypto market near an all time low of 40%, smart contract networks and the projects built on them have taken the majority of the crypto market share by filling a variety of use cases.(2) One key consideration is the efficiency concerns of Bitcoin’s POW mining vs POS consensus that smart contracts use. POS will allow smart contract assets to gain regulation and approval easier in traditional economies. Currently, the market cap of all smart contract platform native tokens is $325B of the total $1.05T crypto market.(3) The five leading assets in this index amount to $270B of the $325B smart contract market.

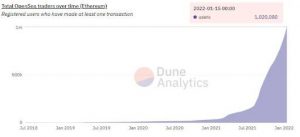

Ethereum, the leading smart contract asset, continues to hit all time highs in addresses holding at least 1 ETH, implying steady growth in individual users since 2017.(4) More recently, product launches on Polygon and Solana in 2021 and partnerships with top global brands have brought record growth, app development, and user activity.(5) This unprecedented engagement has not been without its drawdowns; VC funding is finally slowing down with $14.2B invested in crypto in the first half of 2022, and macro effects have exaggerated an already volatile and emerging market.(6) As smart contract platforms develop their roots in global payments, NFTs, and decentralized finance, the potential for innovation has become too powerful to ignore.(7) (8)

*Compare FreeLunchTrading comprehensive indexes with top international cryptocurrency indexer, Vinter, below. Vinter is simply offering different combinations of the top 20 tokens. 0xFLT captures more quality projects in lower rankings, more adaptive sector categories, and research specific to each asset. This transparent indexing information is much more useful for traders than just a market index designed for traditional financiers.