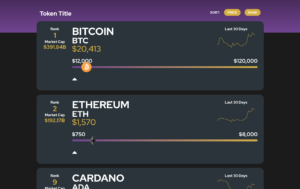

2023 Q3 Crypto Industry Report

CoinGecko’s Q3 report underscores the volatile and rapidly changing nature of the cryptocurrency market. While the industry has faced headwinds, with significant declines in trading volumes and market valuations, the year-to-date figures and the growth in sectors such as RWAs indicate that the foundational interest in crypto assets remains strong.