The CoinGecko 2023 Q3 Crypto Industry Report provides a comprehensive overview of the state of the cryptocurrency market during the third quarter of 2023. Amidst a backdrop of global economic uncertainties, the crypto industry experienced a notable downturn in market activity, with significant declines in trading volumes and market capitalizations across various sectors.

The third quarter of 2023 saw the cryptocurrency market capitalization fall by 10%, a $119.1 billion decrease, marking a shift from the steady growth earlier in the year. Despite this downturn, market capitalization was still up 35% from the beginning of the year, suggesting enduring confidence among long-term investors. Bitcoin’s drop to $26,000 on August 17 exemplified the quarter’s volatility, with no significant news driving the decline.

Trading volumes on centralized exchanges dipped by 20.2% from the previous quarter, indicating a potential slowdown in trader activity. Average daily trading volumes sat at $39.1 billion, down 11.5%. Among the top 30 cryptocurrencies, notable rank changes included Solana’s rise to 7th and TrueUSD’s jump to 19th, while Litecoin, Avalanche, and Binance USD fell in rankings due to various market dynamics, including Binance’s phased-out support for its stablecoin by February 2024.

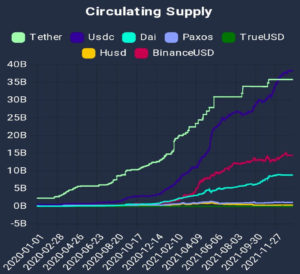

Stablecoins experienced a 3.8% reduction in overall market cap, totaling $121.3 billion. Tether maintained its market cap, while USD Coin saw the largest absolute decline. TrueUSD, in contrast, increased its market cap by 12.8%, a sign of its growing use and trust in the market.

Tokenized U.S. Treasury bills were a highlight, growing from a market cap of $114.0 million in January to $665.0 million by September’s end. This nearly sixfold increase reflects a significant push towards integrating traditional finance assets onto blockchain platforms. Franklin Templeton led this space with almost half the market share, trailed by Ondo Finance and newcomers Backed Finance and OpenEden. Ethereum held 49% of this market, but Stellar closely followed due to its adoption by prominent financial institutions.

NFT trading volume suffered a substantial hit, plummeting by 55.6% to $1.63 billion. Ethereum continued to dominate with over 83% of the market, while Bitcoin and ImmutableX fluctuated in their shares. Gods Unchained’s success on ImmutableX contributed to the platform’s Q3 strength.

Binance faced a challenging quarter as regulatory pressures mounted, leading to a market share drop to 44%, the lowest of the year. HTX (formerly Huobi) rose to third place, with a notable 86.9% increase in trading volume, while Upbit and Bybit also saw gains. However, Kucoin dropped out of the top 10 centralized exchanges.

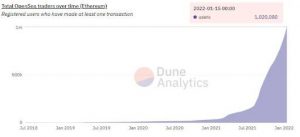

Decentralized exchange volumes fell by 31.2%, and SushiSwap exited the top 10, replaced by Orca. THORchain saw a 113% increase in volume, although some of this activity was linked to illicit transfers. Despite a challenging quarter, THORchain managed a 3% market share by the quarter’s end.

The crypto industry’s third-quarter performance must be viewed within the context of the broader economic and regulatory landscape. The tightening of monetary policy by central banks around the world, increasing concerns about inflation, and geopolitical tensions have all played a role in influencing investor behavior and risk appetite.

Furthermore, the regulatory environment continues to evolve, with various governments and financial authorities taking steps to better understand and regulate the cryptocurrency market. This has led to increased compliance costs and operational challenges for crypto businesses, but also to potential clarity and stability in the long term.

The decline in crypto market activity during Q3 2023 also mirrors the historical trend of reduced trading volumes during the summer months in other financial markets, often referred to as the “summer lull.” As such, while the downturn has affected the short-term outlook for the industry, the year-to-date growth figures suggest that the long-term trajectory of the crypto market remains positive.