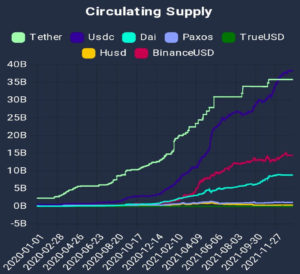

USDC overtaking USDT (Tether) in circulating supply.

USDC overtaking USDT (Tether) in circulating supply. This competition is good. It establishes legitimacy of demand and allows us to not be dependent on any single system. Soon the United States digital dollar will be on this list.